Exchange rates are a key part of international trade and determine the relative price of two currencies. For example, if the exchange rate between the British pound (GBP) and the US dollar (USD) is USD 1.50/GBP, one pound equals $1.50 US dollars. The exchange rate is also known as the "foreign exchange rate".

The exchange rate is the price of one currency in terms of another

The exchange rate is the price of one currency in terms of another. It's a relative price, so it's constantly changing.

Exchange rates are relative prices. (Exchange rates can move up and down, but they cannot be negative)

Exchange

rates are not relative prices. The exchange rate of a currency is not

determined by the cost of other currencies in the market but by supply and

demand. If there is more demand for money than supply, then its value will

increase relative to other currencies on average.

When people say "the exchange rate has done well, " they mean that the price of one currency has increased compared to another currency or basket of currencies over time. For example, if an investor buys British pounds at $1.50 today and sells them tomorrow at $1.60, then they will have made money (on paper).

However, if another investor buys British pounds today at $1.60 and

sells them tomorrow at $1 - this purchase would also be considered a "good

deal".

Why do people believe that exchange rates move up or down? There are two main reasons: firstly, some countries have experienced inflation since 1990; secondly, these nations have experienced periods where their economies have performed poorly (i.e., negative growth).

Exchange rates are relative prices that are constantly changing

Exchange

rates are relative prices that are constantly changing. This means that the

price of one currency in terms of another currency is constantly changing too,

but it does not mean that exchange rates move up and down for no reason.

Exchange rates can move up and down for reasons related to changes in supply, demand,

interest rates, and economic growth.

For

example: If there were no supply changes (more money printed), then an increase

in demand would cause prices to go up as well because more people want

demanding things with their extra cash on hand; however, there aren't any

changes made regarding how much money is printed, so supply stays at the same

level while demanding increases which makes prices rise due only because

there's been an increase in demand which has caused them

Learning about how exchange rates work will help you trade more efficiently and profitably

When

learning about exchange rates, it's

essential to understand that they are not fixed. Exchange rates move up and

down according to supply and demand. In other words, the value of one currency

relative to another is constantly changing based on what one can do with their

money (buy goods, invest in property - etc.) in each country.

This concept is also known as purchasing power parity (PPP). The International Monetary Fund explains PPP: "The theory of purchasing power parity states that equal amounts of money should buy equal amounts of goods and services in any two countries after considering the relative costs of living."

In other words, if you have one dollar today, then your ability to buy something with that dollar should be similar whether you are in the United States or Zimbabwe because your dollar will buy more if its value has decreased against the local currency than if it has increased by buying less for the same amount of US dollars back home.

Conclusion

Now that you know more about exchange rates, you can better understand how they work. The key takeaway is that exchange rates are relative prices and will often move up and down about each other.

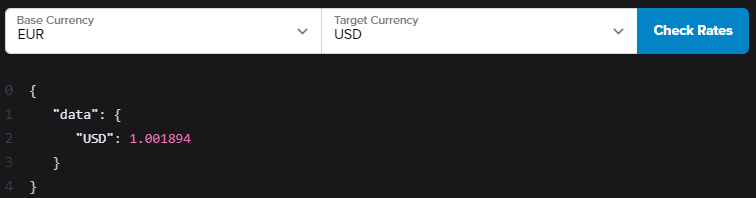

This means that it's essential to keep an eye on their movement so that when the time comes for investing or trading foreign currencies, you'll be prepared with knowledge of what's happening with them right now! It is also an option to monitor exchange rate APIs like freecurrencyapi.com.

If you have any doubt related this post, let me know